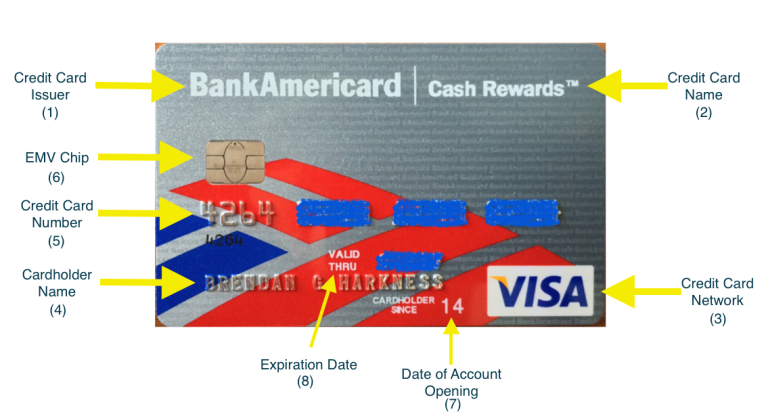

When you look in your wallet, you might find an array of cards looking back at you. While the card colors and designs may vary, all credit cards have consistent information found on them. Let’s take a look at what’s on a credit card.

Front of a Credit Card

Credit card design trends are ever-changing, but most cards share several features, including (but not limited to) the issuer name, the network, the cardholder’s name, and the card number.

1. Credit card issuer

This is the bank that issued the credit card. You apply to this bank to get the card, and it determines card details like reward points and benefits. In this case, Bank of America just relies on the card name to indicate the issuing bank.

2. Credit card name

This is the name of this specific credit card. Card names often begin with the name of the issuing bank followed by the particular card name, but in the above case “Bank of America” and “Credit Card” are stylized into “BankAmericard,” the word they use to begin most of their card names, followed by the name of this particular card: “Cash Rewards.”

3. Credit card network

This is the credit card network and level of service associated with this card. If this card were of Visa Signature status, it would say so right here. The credit card network is responsible for processing payments made with the card, and there are 4 of them:

- Visa

- Mastercard

- American Express

- Discover

4. Cardholder name

The name of the owner of the card.

5. Credit card number

This is the identifying number associated with this particular card. It is stored in the magnetic strip. When you swipe your card at a terminal or reader, your number provides information about the credit card network and the issuer.

Credit card numbers are assigned by the American National Standards Institute and the ISO or the International Organization for Standardization. Your account number consists of up to sixteen digits and is allocated by your card issuer. Some cards have only seven digits.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

TMI About Credit Card Numbers

There’s actually a ton of information contained in a credit card number. This information isn’t really necessary for understanding how to use a credit card, it’s just here so you can learn for fun. The ISO or the International Organization for Standardization categorizes the numbers like so:

Digits 1 – 6: Issuer identifier numbers

First digit: Represents the network that produced the credit card. It is called the Major Industry Identifier (MII). Each digit represents a different industry.

- 0: ISO/TC 68 and other industry assignments

- 1: Airlines

- 2: Airlines, financial and other future industry assignments

- 3: Travel and entertainment

- 4: Banking and financial

- 5: Banking and financial

- 6: Merchandising and banking/financial

- 7: Petroleum and other future industry assignments

- 8: Healthcare, telecommunications and other future industry assignments

- 9: For assignment by national standards bodies

The first digit is different for each card network:

- Visa cards begin with a 4 and have 13 or 16 digits

- Mastercard cards begin with a 5 and has 16 digits

- American Express cards begin with a 3, followed by a 4 or a 7 has 15 digits

- Discover cards begin with a 6 and have 16 digits

- Diners Club and Carte Blanche cards begin with a 3, followed by a 0, 6, or 8 and have 14 digits

Digits 2 – 6: Provide an identifier for a particular institution

Digits 7 – 15: Unique personal identifiers

- Identify the cardholder name

- Unique to the issuer

Digit 16: Check digit

- This last digit verifies card numbers for accuracy to make sure that they weren’t input incorrectly

The rest of the digits are also different for each card network:

Visa cards:

- Digits 2 – 6: Make up the bank number

- Digits 7 – 12 or 7 – 15: Represent the account number

- Digits 13 or 16: Is a check digit

Mastercard cards:

- Digits 2 & 3, 2 – 4, 2 – 5, or 2 – 6: Make up the bank number; depends on whether digit two is a 1, 2, 3 or other digit

- Digits after the bank number, up to digit 15: Represent the account number

- Digit 16: Is a check digit

American Express cards:

- Digits 3 & 4: Are type and currency

- Digits 5 – 11: Represent the account number

- Digits 12 – 14: Represent the card number within the account

- Digit 15: Is a check digit

6. Chip EMV® Technology

This chip is an alternative method of holding the cardholder’s information, in addition to the magnetic stripe (which is on the back of the card). It is a more secure and modern form of information storage, providing better protection against fraud.

This is known as EMV® technology, which stands for “Europay, Mastercard, Visa.” This is the global standard for this chip technology, which comes in two forms:

- Chip-and-Signature

- Chip-and-PIN

Chip-and-Signature cards require your signature to complete a transaction, while Chip-and-PIN cards use a PIN that you create, much like a debit card. Credit cards can be either one of these types, or both.

It is most common to find only Chip-and-Signature cards in the U.S. as of now, but that situation is changing and more cards will be enabled with both in the future.

Instead of swiping the credit card through a groove, you insert a chip-enabled card into a slot on the reader, usually on the bottom, and leave the card there until you are prompted to remove it. This is referred to as “card dipping.”

Credit cards issued in the United States are required by law to be chip-enabled by the beginning of October, 2015, and at that date merchants who do not comply with the new standards by providing the correct technology for the chip cards will be held liable for fraudulent credit card activity.

7. Date of account opening

The year that this credit card account was opened. Not all cards will show this information.

8. Expiration date

The date at which this particular card will expire. This does not mean that the credit account is closed; instead, this usually only means that it’s time to get a new card. The new card will automatically be mailed to you by the credit card issuer and will have a new expiration date and CVV code, and sometimes a new account number.

In some cases, however, credit card issuers also use this time to analyze the credit of the cardholder, and potentially make decisions about the card terms such as lowering your credit limit, increasing the interest rate, suspending the account, or even closing the account.

However, keep in mind that issuers can take any of these actions if they deem it necessary at any time, and don’t need to wait until the expiration date. The date only gives the issuer a predefined end to the relationship if they choose to end it.

If your credit reports show responsible financial behavior, you don’t have to worry about any of these negative, or adverse, actions. Instead, you will probably be mailed a new card with new details well ahead of the expiration date, because the card issuer recognizes you as a good customer and wants to keep you around.

Cards have an expiration date:

- To give issuers a predetermined end to your relationship, so they can end it if they so choose

- Because normal wear and tear will slowly break a card down, and damage the magnetic stripe making it eventually unreadable

- As a fraud protection measure, because it acts as an additional form of card verification (which is why the date above is censored)

- As a way for credit card issuers to replace old cards with new cards with better security features or fresh designs

- As a way for credit card issuers to remind cardholders that they own the card by sending them a new one

Back of a Credit Card

1. Magnetic stripe

Also known as the magstripe, this black bar holds all of your account information. It’s made of millions of tiny magnetic particles. When you swipe your card through a card reader terminal, the reader gets your account information from the magstripe and uses it to process the transaction.

If an ATM or card reader can’t accept your card, the problem is most likely:

- The magstripe is too dirty or scratched to be read

- A magnet has erased the information on the magstripe

If your card’s magstripe doesn’t work, you can call your card issuer to request a new card. There will usually be no charge for getting a replacement card for this reason.

2. CVV security code

This code is a fraud-prevention tool, used when making card-not-present transactions, such as online purchases that don’t require you to actually have the physical credit card. You just need the information printed on it.

These are the opposite of those transactions where you actually use the plastic card, such as when checking out at a grocery store, where you would use the magstripe or chip.

CVV codes are a 3-digit number for Visa, Mastercard, and Discover cards, and a 4-digit number for Amex.

3. Customer service phone line

The phone number on the back of your card is the best number to use for general customer service. If you have other services associated with your card that have their own direct phone numbers, like a personal concierge service, consider obtaining them all and writing them down or storing them in your phone.

You can get help finding these numbers by calling the customer service line on the card.

4. Signature box

This is another fraud-prevention tool, but this one rarely serves its purpose. The cardholder must sign their card here for the card to be legally valid, with the intention that this signature can be matched with a driver’s license or a signature given at the register when a purchase is made.

By matching the signatures or the name on the license, you can see that the person using the card is truly the owner of that card. However, merchants will rarely check to see if there is a signature here, and it’s even less common for them to double-check that name on a license.

In many cases the retailer never even touches the credit card.

5. Hologram security feature

This hologram is a security feature meant to prevent the card from being physically copied. It contains several layers of images at different angles, giving it the illusion of some motion. There can also be other images hidden within these layers.

The multiple layers and hidden images make the hologram difficult or impossible to copy with a scanner, so a true image can’t be created to print copies of the card with.

Frequently Asked Questions

What is a credit card?

A credit card is a physical payment card that allows consumers to borrow money to make purchases that must then be repaid. Credit cards generate money for card issuers by charging customers interest fees on their card balances (learn how interest can be avoided).

Beyond allowing cardholders to make purchases, credit cards often earn spending rewards and provide other benefits, from travel protections to concierge service. They’re known for their security benefits, too, generally offering $0 fraud liability policies and stronger federal protections than debit cards.

What is a credit card number?

A credit card number is the string of numeric digits that identifies the credit card. It’s usually (but not always) displayed on the front of the card, and it generally (but not always) features 15 or 16 digits.

The digits of a card number correlate with a variety of information — the first digit identifies the credit card network, the second through sixth #digits identify the financial institution, the seventh through fifteenth digits include unique identifiers related to the cardholder name and issuer, and the final digit is known as the “check digit,” which helps ensure the number was input properly.

Where’s your security code/CVV?

Your security code — also known as your card verification value (CVV) — is usually visible on your physical credit card (there are exceptions, like the Apple Card).

With Visa, Mastercard, and Discover credit cards, your CVV is a three-digit number shown on the back of your card. American Express security codes, sometimes known as card identification numbers (CID), can be found to the upper-right of the credit card number on the front of the card.

The Short Version

- Most cards share several features, including (but not limited to) the issuer name, the network, the cardholder’s name and the card number

- Your account number consists of up to sixteen digits and is allocated by your card issuer. Some cards have only seven digits

- Your security code — also known as your card verification value (CVV) — is usually visible on your physical credit card